|

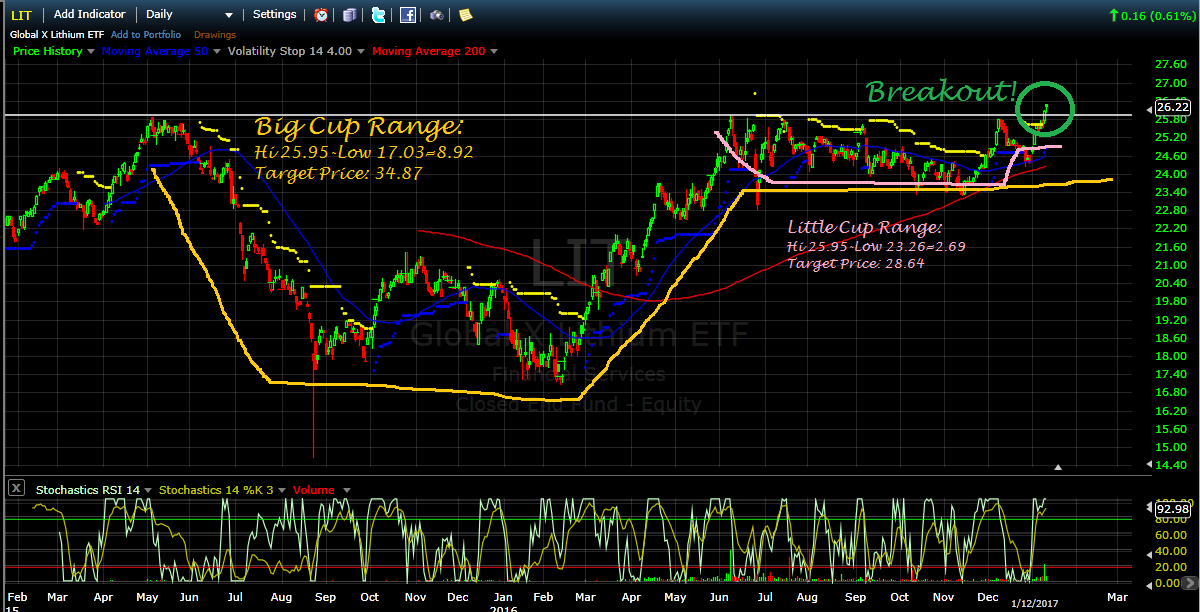

LIT, the Lithium ETF, has been doing well this year since it broke out from its multiple cup and handle's. It executed a nice throwback to test and then rallied some more to reach it's first target from the small cup and handle. We might see LIT close the gap before regaining momentum and rallying into the lower to mid 30s. Don't forget to subscribe to the letter if you haven't yet over on the right hand side. There may not be frequent updates on the website, but the letter goes out frequently trading guidelines and thoughts on various sectors.

0 Comments

Is it time to buy lithium? Judging by the price action now is a great time to buy LIT after breaking out from not one, but two, cup and handle formations for a long term target of 34.87. Remember to subscribe to the ETF Junkie Newsletter over on the right side of the page.

Below is an updated list of 3x leveraged ETFs that I use in order to trade. I eliminated all ETFs from the list I had last year that have extremely low volume and also removed ETFs that were discontinued through the year like UWTI and DWTI.

Remember to subscribe to the ETF Junkie Newsletter over on the right side of the page.

List of Best ETF Newsletters: Number 1: ETF Junkie. Do I say this out of hubris? Perhaps. But if you look at other ETF trading newsletters, you’ll see that they love to boast just their winners and never give you the details of their trading history. If you look on their websites, it’s nothing but winners, yet they don’t show an annualized return. With the ETF Junkie, it’s easy to follow and the returns are tracked and published in each newsletter. The ETF Junkie is also fantastic in that we send out trading ideas in the evening so that you have plenty of time to put in the trades. This way you don’t have to be monitoring your email every minute in case there’s a last minute trade that you can’t execute because you have a life to live. All others are charlatans. I have looked at these jokers and they always bring up their good trades, but don’t keep track of how well their overall trade strategy would work. They also tell you to buy here, but in what size? Where do you get out? What kind of position sizing do you do? The others: Morpheus Trading Group: They seem to have good trades according to their free email they send out, but it’ll cost you more than $700 a year to get their trades in real time. Who knows if you’ll be free to trade their ideas when they send out their emails. ActiveTradingPartners.com: These guys say you can “trade like a pro” for $116 dollars a month. Whatever Bud. Why don’t you trade with a Pro at the ETF Junkie. I trade the positions alongside you. Morningstar ETFInvestor Newsletter: This is a Monthy Newsletter that costs $200 a year? Any information given once a month is going to be stale and not really actionable. Buying an index fund and sitting on it is better that wasting money on this not so “Newsletter”. Doug Fabian: Doug offers a more reasonably priced newsletter and gives you the entry and exit points which is nice, but he’s reckless with his stops. Let’s look at Fabian’s current open trades taken from the website at the end of 2016: First, all three are losing positions. Second, he gives you entry and exit prices, which is nice, but there’s no position sizing. But the coup d’grace are the stops are ridiculously far away from entry and leave you open to huge losses. Looking at his first trade of SILJ, if it gets stopped out you are going to lose over 27%? That’s serious money. You want to trade with a pro who keeps his losses much smaller than that. ETFSwingtrader.net: First, if you can’t get the .com on your name it’s suspect. Second, $79 a month is a ridiculous price to pay for something that doesn’t show their results. $10 less and it would be kinky. Clearly, the ETF Junkie is the best place to go for trading ETFs, not only because of the returns, but because I’m not afraid to talk about my competitors. They clearly don’t show the same confidence. Remember to subscribe to the ETF Junkie Newsletter over on the right side of the page.

ETF Junkie Year End Summary 2016

The ETF Junke had a great 2016 finishing up 22.52% beating the S&P 500 (using SPY’s #’s) by 10.5% whose total return was up 12% for the year. We had a total of 40 trades open and closed in 2016. (LABD is still working with half of the position closed up 12.8%)

Of the positions that were closed, 24 trades were losers & 16 winners, and currently, we have 3 open trades which are all winners at the moment.

GUSH was our biggest percentage winner on the year with a portion of our position making 116%. Unfortunately, this position was a small 10% of our portfolio and only 5% of the portfolio enjoyed the 116% gain, the other 5% gained “only” 40.16%.

Held for 62 days. This is half of the position w/ first half closed out

Held 5 days

Biggest Dollar winner: Our LABD trade from 9/29 was our biggest money maker for 2016, making $21,206.65 on a large exposure trade.

Biggest % Loser: One of 3 times we tried to time the bottom of Natural Gas, which all failed. On January 8th, we bought 5% of our portfolio into UGAZ and lost 27.37% in less than a week. If we held the position into the rally in the spring, we still wouldn’t have made it back to break even. It was only a small position so the damage wasn’t too bad.

Biggest $ loser: Our biggest dollar loser comes from a trade in May where we had a large position in TZA that was too generous with the stop.

More stats: The position held for the longest period was GUSH, which was held for 62 days. The shortest hold was for one day and it is held by three positions: TNA from January, UGAZ and LABU from January. Obviously, these were all closed out for a loss. On average the hold period was 13 days for our trades in 2016.

Lessons Learned: The second half of 2016 was definitely better for the Junkies than the first half. In the beginning of the year I was a little to active trying to force trades because I thought I had to be more active writing the Junkie on a regular basis. The best course of action as a trader and for the Junkies is to wait for trades to materialize that fit criteria instead of forcing it, and not being as generous with the stops. If a trade goes against you a little, it’ll most likely go against you a lot so it’s best to cut your losses early. This is well know, but putting into practice proved true in the second half where we had our best performance.

Also, a lot of our worst performing trades were in the commodity sector with trades in Oil and Natural Gas. There is too much geopolitical risk in the trades with OPEC and other entities able to manipulate the markets at their whim. Sticking to stocks (even energy stocks) proves to be less volatile and easier to trade with my preferred strategies.

Finally, as proven by our results, every trade doesn’t have to be a winner as long as you cut your losses early. Shit, you can have a positive year while also having more than half of your trades be losers.

We are starting the year off on a good foot with 3 profitable trades. Here’s to a great 2017 Junkies.

Remember to subscribe to the ETF Junkie Newsletter over on the right side of the page.

|

AuthorBrad Price, the founder of ETF Junkie, has more than 15 years experience trading the markets. Archives

May 2017

Categories |